"Things To Do Today" Daily Agenda Pad, One-Part (No Copies), 8.5 x 11, 100 Forms Total

1096 Tax Form for Dot Matrix Printers, Fiscal Year: 2023, Two-Part Carbonless, 8 x 11, 10 Forms Total

1099-DIV Tax Forms for Inkjet/Laser Printers, Fiscal Year: 2023, Five-Part Carbonless, 8 x 5.5, 2 Forms/Sheet, 24 Forms Total

1099-INT Tax Forms for Inkjet/Laser Printers, Fiscal Year: 2023, Five-Part Carbonless, 8 x 5.5, 2 Forms/Sheet, 24 Forms Total

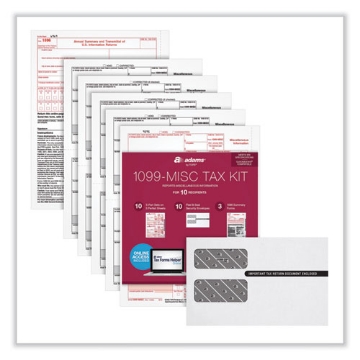

1099-MISC Five-Part Laser Forms and Envelopes, Fiscal Year: 2023, 5-Part Carbonless, 8 x 5, 2 Forms/Sheet, 10 Forms Total

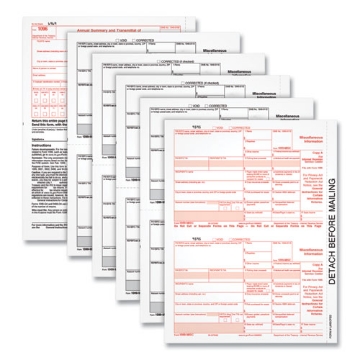

1099-MISC Tax Forms, Fiscal Year: 2023, Five-Part Carbonless, 8.5 x 5.5, 2 Forms/Sheet, 50 Forms Total

Zero Waste Policy

Our office is committed to minimizing environmental impact and promoting sustainable practices. This Zero Waste Policy outlines our dedication to reducing waste generation, increasing recycling efforts, and fostering a culture of sustainability among our employees.

30 Days Return

We strive to provide our customers with high-quality products and excellent customer service. If, for any reason, you are not completely satisfied with your purchase, we are here to assist you with our return policy.

Sustainability

At TIC Express we are committed to integrating sustainable practices into our daily operations to minimize our environmental impact and contribute to a more sustainable future. This sustainability policy outlines our commitment and actions to promote environmental responsibility within our office.

Free Shipping

Always free shipping with TICExpress

.png)

.png)